News

Kashat in the News

FEATURED

Kashat Celebrates Full-Country Expansion, Increases Nano Loan Limits

The region’s first nano-financial services provider, Kashat, has launched in nine new governorates in Egypt, the company said in a press release (pdf). The company is now operating in 24 of the country’s 26 governorates, putting its services in reach of 100.4 mn people. Kashat has raised its loan limit to EGP 2k to accommodate more of the country’s unbanked population. Kashat users can also now withdraw and repay their loans through all telecom and bank e-wallets available in Egypt, according to the statement.

Mastercard and Egyptian Fintech Kashat Sign Five-year Deal

In a move that will see enhanced financial services for people in Egypt, Mastercard and Egyptian fintech Kashat have signed a five-year agreement that will digitize the onboarding, disbursement, and collection processes for MENA’s first nano financial service provider.

AI Creates Job Disruption But Not Job Destruction

A common concern surrounding automation in recent years is that it will result in widescale job losses as the work previously done by people is taken over by technology. Of course, the reality doesn't really support this narrative, and indeed, companies that invest in technology often end up employing more people as a result of the improvement in their fortunes heralded by the investment.

LATEST NEWS

Kashat Raises Investment from Cairo Angels

The Cairo Angels, a global network of angel investors focused on supporting startup opportunities in Egypt, the Middle East and Africa, is delighted to announce its most recent investment in the financial technology startup Kashat.

Egypt’s Kashat Launches Country’s First Nano Lending Mobile App Offering Short-term Loans up to $100

Kashat, a Cairo-based fintech has launched its Android-only mobile app that offers short-term loans between EGP 100 (USD 6.33) and EGP 1,500 (~$95) to the users in Cairo and Alexandria, it told MENAbytes earlier this month. The app that’s designed for the unbanked segment of Egypt aims to help users cultivate a financial identity by providing them with instant credit.

Egyptian Fintech Startup Kashat Raises $1.75m Bridge Funding Round

Founded in 2019 by Sumair Farooqui and Karim Nour, Kashat is the first nano lending mobile application in Egypt, offering short-term loans of between EGP200 (US$13) and EGP1,500 (US$95) with a repayment plan up to 61 days. The product is designed to serve unbanked Egyptians.

How to Identify the Pain Points That Make Customers Decide What They're Going to Buy

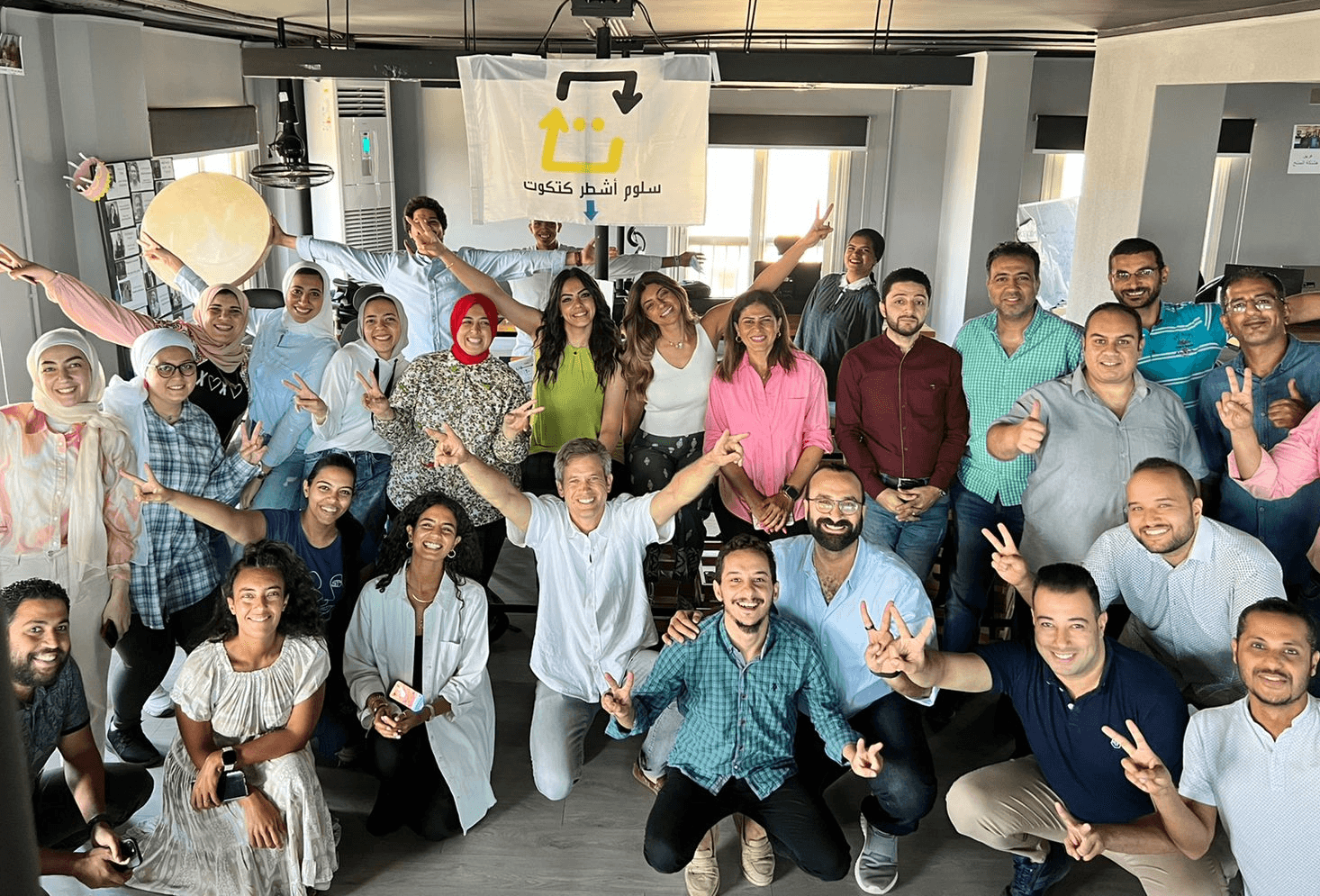

As Karim Nour, co-founder and CEO of Kashat, MENA’s first nano financial service provider, explained in a recent conversation: “We make it a point to invite a handful of customers to our office every month to discuss...user experience. This gives us in-depth knowledge of how they are using our app and what we can do better to meet their needs — and all it costs is a cup of coffee.”

We are always very excited to share our company’s journey and updates!

If you would like to request an interview or ask us a few questions, drop us a line at media@kashat.com.eg

EGYPT's First Nano Financial Service Provider

Powering Access to Digital Financial Possibilities

Kashat serves as the entry point to financial inclusion for the un- and underbanked population in Egypt by offering instant, small, short-term, productive loans.