Widening Access to Credit for +100MN Egyptians

Kashat uses AI and non-traditional data to lower the barrier to entry and tackle financial exclusion. Going further beyond lending, we are now moving into payments and many other services.

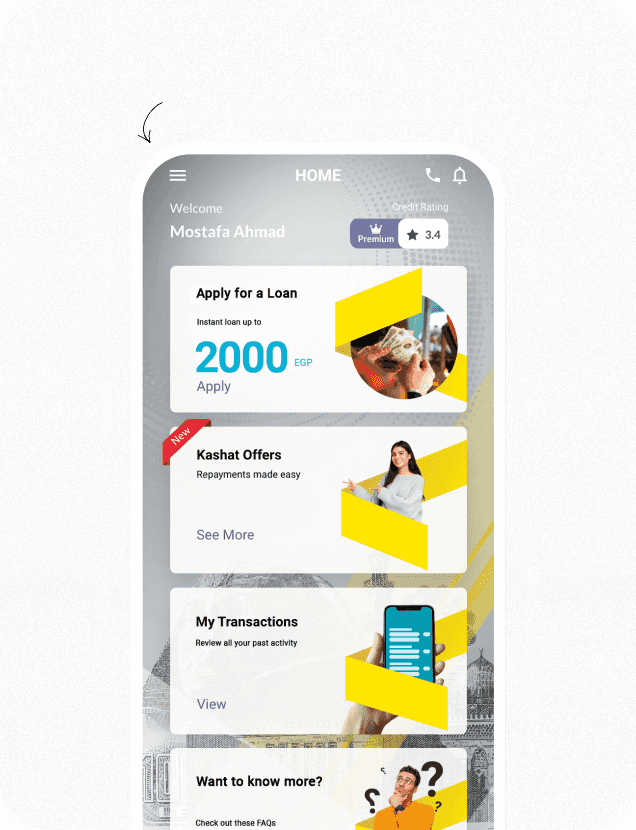

NANO LOANS

Reliable. Paperless. Seamless. Hassle-free.

Instant Withdrawal

Get cash in hand within minutes from approval.

Small Amounts

Starting from EGP 100 only, and ranging to EGP 3,000.

Dynamic Pricing

Admin fees that can go as low as 8%.

Convenient Repayment

Flexible plans going up to 91 days.

Basic Requirements

No complex documentation needed; only a valid ID.

Large Network of Channels

For disbursement and collection

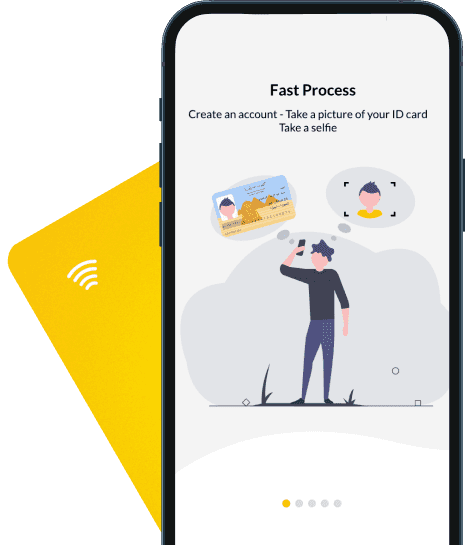

How it Works

Simple Steps. Instant Loans.

- 1

Download the app for free from

- 2

Create an account with basic personal information.

All you need to submit is your National ID and a Selfie. It will be activated within 48 hours.

- 3

Apply easily for a loan by just answering a few simple questions.

Upon approval, the amount will be immediately disbursed to your digital wallets, or you can withdraw them from our partner branches.

Become a premium user!

Get access to higher loan limits and lower admin fees faster when you become a premium user. Your profile will be upgraded after you take out four loans, use the early payment offers, and make sure you meet the installment deadlines.

EGYPT's First Nano Financial Service Provider

Powering Access to Digital Financial Possibilities

Kashat serves as the entry point to financial inclusion for the un- and underbanked population in Egypt by offering instant, small, short-term, productive loans.